Little Known Questions About Eb5 Investment Immigration.

Table of ContentsSome Known Incorrect Statements About Eb5 Investment Immigration More About Eb5 Investment ImmigrationEb5 Investment Immigration Can Be Fun For AnyoneThe Eb5 Investment Immigration StatementsAn Unbiased View of Eb5 Investment Immigration

While we make every effort to offer accurate and updated material, it should not be considered lawful advice. Immigration laws and laws are subject to change, and specific circumstances can differ extensively. For customized assistance and lawful recommendations concerning your details immigration situation, we strongly recommend seeking advice from a qualified migration attorney that can supply you with tailored aid and make certain conformity with present laws and laws.

Citizenship, through investment. Currently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Areas and Rural Locations) and $1,050,000 in other places (non-TEA zones). Congress has accepted these quantities for the next five years beginning March 15, 2022.

To receive the EB-5 Visa, Investors must develop 10 full-time U.S. tasks within two years from the date of their full investment. EB5 Investment Immigration. This EB-5 Visa Requirement makes sure that investments contribute directly to the U.S. job market. This uses whether the work are developed straight by the industrial venture or indirectly under sponsorship of an assigned EB-5 Regional Center like EB5 United

The Eb5 Investment Immigration Diaries

These tasks are identified through designs that use inputs such as growth expenses (e.g., construction and tools costs) or yearly earnings generated by ongoing operations. In contrast, under the standalone, or straight, EB-5 Program, just direct, full time W-2 worker placements within the commercial enterprise might be counted. A crucial threat of relying exclusively on direct workers is that staff reductions as a result of market problems could cause insufficient full-time positions, potentially resulting in USCIS rejection of the capitalist's petition if the task production need is not fulfilled.

The financial model then forecasts the number of straight work the brand-new organization is likely to create based upon its expected earnings. Indirect work determined through economic versions refers to work produced in industries that supply the goods or services to the company directly entailed in the project. These jobs are created as a result of the raised demand for products, products, or solutions that support the organization's operations.

8 Simple Techniques For Eb5 Investment Immigration

An employment-based 5th preference category (EB-5) investment visa supplies an approach of becoming an irreversible united state resident for international nationals wishing to invest resources in the USA. In order to look for this copyright, a foreign financier should spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and create or maintain at the very least 10 full time work for United States employees (omitting the capitalist and their prompt household).

Today, 95% of all EB-5 resources is raised and spent by Regional Centers. In many areas, EB-5 investments have filled up the funding void, providing a brand-new, essential source of capital for neighborhood economic advancement projects that rejuvenate areas, create and sustain jobs, infrastructure, and solutions.

Facts About Eb5 Investment Immigration Revealed

More than 25 countries, including Australia and the United Kingdom, usage similar programs to attract foreign financial investments. The American program is more rigid than many others, needing significant risk for capitalists in terms of both their economic investment and migration standing.

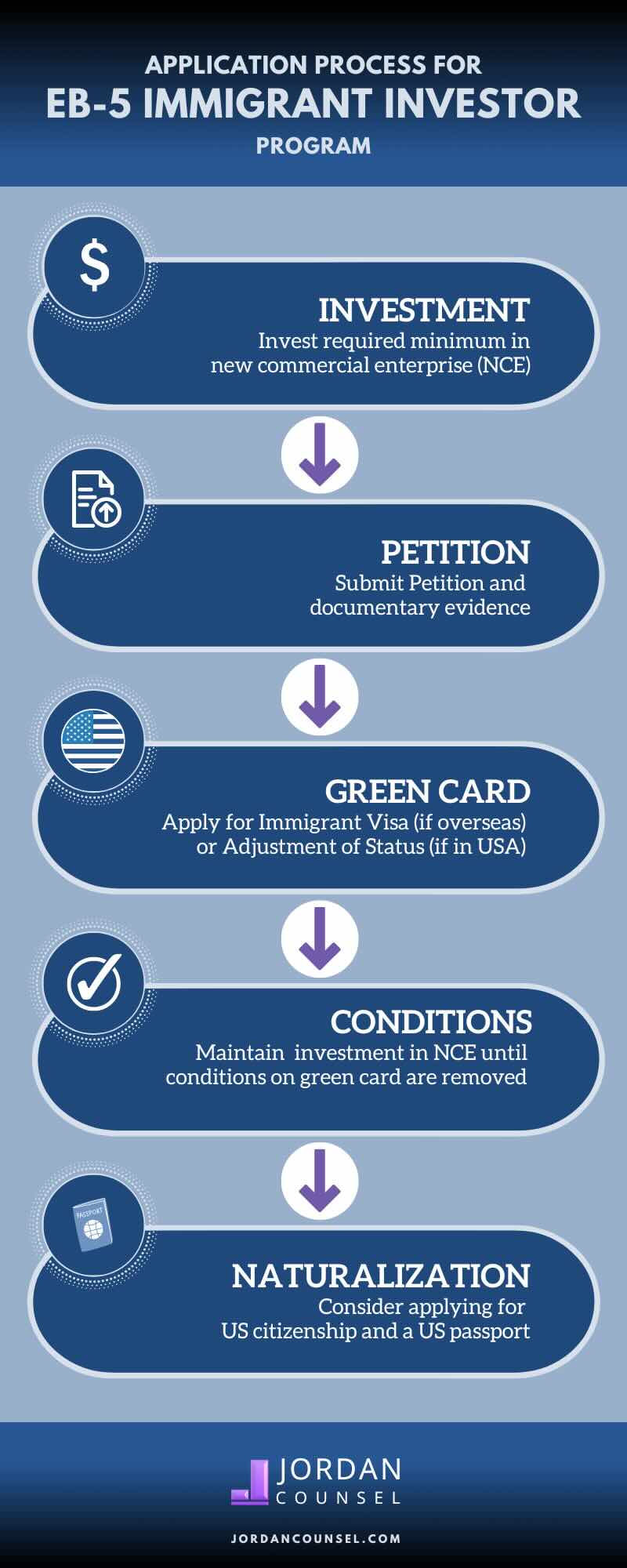

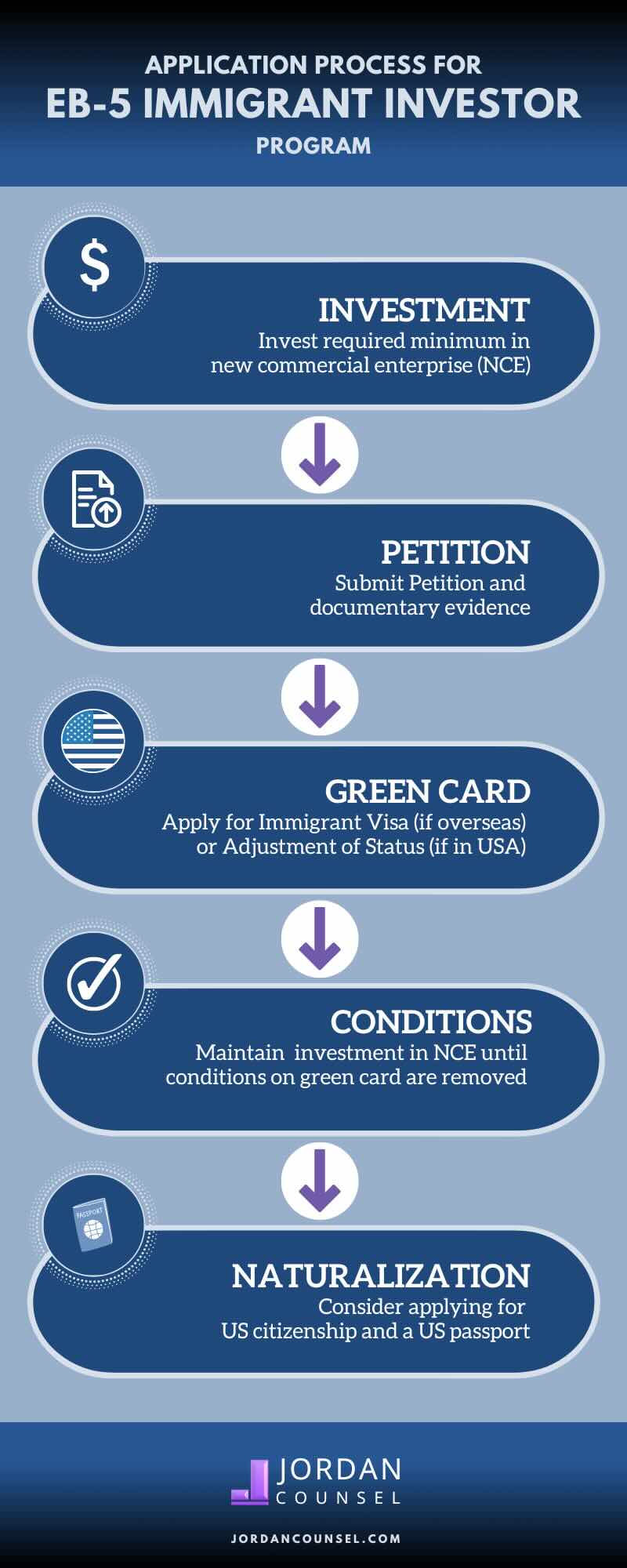

Households and individuals that look for to move to the United States on a long-term basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Immigration Services (U.S.C.I.S.) established out different demands to acquire irreversible residency through the EB-5 visa program.: The i thought about this first action is to discover a certifying investment chance.

Once the possibility has been identified, the financier should make the investment and submit an I-526 request to the U.S. Citizenship and Immigration Solutions (USCIS). This request needs to include proof of the investment, such as financial institution declarations, acquisition contracts, and organization strategies. The USCIS will certainly review the I-526 request and either accept it or request extra evidence.

The Of Eb5 Investment Immigration

The financier needs to make an application for conditional residency by submitting an I-485 request. This petition should be submitted within 6 months of the I-526 authorization and must include evidence that the financial investment was made which it has actually created at the very least 10 permanent tasks for united state workers. The visit this web-site USCIS will assess the I-485 application and either authorize it or demand added evidence.